How Specialized Catheter for Food Systems Address Critical Gaps in Infant Medical Feeding

Introduction: The Hidden Challenge in Pediatric Care Distribution

When Sarah Mitchell, procurement manager for a regional hospital supply chain, received urgent requests from neonatal units for more effective infant feeding solutions, she discovered a troubling reality: standard baby medicine dispensers were failing children with special medical needs. Babies with cleft palates, swallowing disorders, premature birth complications, and neurological conditions required precision feeding tools that simply weren’t available through conventional suppliers.

This scenario plays out daily across hospitals, specialty pharmacies, and pediatric care facilities worldwide. The gap between what’s commercially available and what medical professionals actually need has created a critical market opportunity for distributors who understand the unique demands of specialized infant care.

Market Pain Point #1: One-Size-Fits-All Products Fail Special Needs Populations

The Problem with Standard Baby Feeding Tools

Traditional baby medicine droppers and feeding syringes are designed for healthy, full-term infants with normal oral-motor function. However, approximately 15% of newborns globally face feeding challenges requiring specialized equipment:

- Premature infants (born before 37 weeks) often lack coordinated suck-swallow reflexes

- Cleft lip/palate patients cannot create proper suction with standard bottles

- Neurological conditions may require controlled, gradual food delivery

- Post-surgical cases need gentle, non-invasive feeding methods

Generic feeding products force these vulnerable populations to struggle with tools not designed for their conditions. Medical staff resort to improvised solutions, creating inconsistent care standards and increased aspiration risks.

The Custom Solution Advantage

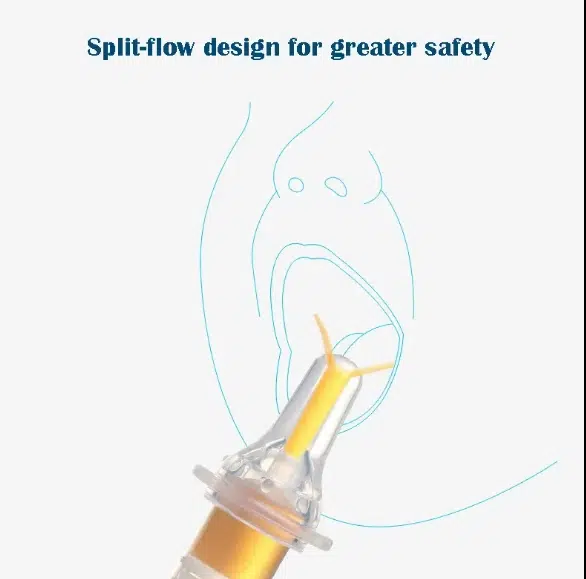

A properly engineered food syringe with specialized catheter design addresses these critical gaps through:

Variable Flow Rate Control: Customizable nipple designs accommodate different sucking strengths, from weak premature infant reflexes to controlled therapeutic feeding protocols. Unlike standard dispensers, medical-grade food catheter systems allow precise ml-per-minute delivery rates.

Ergonomic Adaptations: Extended catheter lengths for oral-aversive infants, angled tips for positioning challenges, and textured grips for caregivers managing multiple medical devices simultaneously—these modifications transform a basic tool into a therapeutic device.

Graduated Capacity Options: While retail products typically offer only 5ml or 10ml capacities, medical facilities require 2ml micro-dosing syringes for neonatal ICU applications and 15ml+ volumes for older special needs children receiving blended diet protocols.

Market Pain Point #2: Regulatory Compliance Nightmares in Medical Device Importing

The Hidden Costs of Non-Compliant Products

Maria Gonzalez learned this lesson the hard way. As purchasing director for a South American pharmacy chain, she imported 100,000 units of baby feeding syringes from a budget manufacturer—only to have the entire shipment rejected at customs for lacking proper FDA documentation.

The financial impact was devastating:

- $45,000 in detained inventory

- $12,000 in storage fees during the compliance review

- Lost market opportunity during peak cold/flu season

- Damaged reputation with retail partners expecting timely delivery

This scenario repeats across international markets where distributors underestimate the complexity of medical device regulations for infant feeding products.

Why “Food-Safe” Isn’t Enough for Medical Applications

Many importers assume that basic food-contact compliance certifies a product for pediatric medical use. This dangerous misconception stems from confusion between:

Consumer Product Standards (basic safety for retail baby items) vs. Medical Device Classifications (regulated under FDA 21 CFR 880.5400 for infant feeding devices)

A catheter for food syringe used in hospital settings requires documentation that standard retail toys and feeding accessories don’t need:

- Biocompatibility testing (ISO 10993 standards)

- Sterilization validation protocols

- Extractables/leachables testing for liquid medication contact

- Clinical performance data for therapeutic feeding claims

The Custom Manufacturing Compliance Solution

Working with a specialized OEM partner transforms regulatory compliance from obstacle to competitive advantage. When you source FDA-approved food catheter systems from manufacturers with established certification frameworks, you receive:

Complete Documentation Packages: SGS material certifications, FDA registration numbers, EN14350 European compliance, and CPSIA lead/phthalate test reports—all prepared for customs clearance and retail audits.

Regional Adaptation Support: Labeling requirements vary dramatically between markets. Japanese importers need JIS standards documentation, while EU distributors require CE marking with notified body validation. Custom manufacturing partners provide market-specific compliance variations without requiring separate tooling investments.

Liability Protection: Proper certifications shift product liability responsibility to the manufacturer’s quality systems rather than the distributor. This protects your business from lawsuits arising from product failures or safety incidents.

Market Pain Point #3: The Bulk Order Minimum Trap

Small Orders, Big Problems

James Chen faced a classic dilemma. His medical supply startup identified strong demand for specialized infant feeding syringes among home healthcare agencies serving special needs children. However, every manufacturer he contacted required minimum orders between 100,000-500,000 units.

The math didn’t work:

- His initial market could absorb only 25,000 units annually

- Storage costs for excess inventory would eliminate profit margins

- Product design improvements based on customer feedback couldn’t be implemented without committing to massive reorders

This minimum order quantity (MOQ) barrier keeps innovative distributors out of specialty markets, leaving underserved populations with inadequate solutions.

The 50,000-Unit Sweet Spot

Strategic MOQ structuring at 50,000 units creates the perfect balance for medium-scale distributors entering specialized markets:

Financial Accessibility: At this volume, per-unit costs drop to competitive wholesale levels (typically 40-60% below retail pricing) while total investment remains within mid-sized company budgets ($15,000-$35,000 depending on customization).

Market Testing Flexibility: A wholesale food syringe order of 50,000 units allows regional market testing across multiple channels—hospital networks, specialty pharmacies, therapy clinics, and online medical supply retailers—without overcommitting capital.

Rapid Iteration Capability: Unlike mega-orders requiring 18+ months to deplete inventory, 50K unit volumes allow product refinement within 6-9 month cycles. Customer feedback can drive version 2.0 improvements while version 1.0 remains current.

Customization Without Custom Tooling Costs

The breakthrough for specialty market distributors comes from manufacturers offering modular customization within standard platforms:

A base catheter for food syringe design accommodates:

- 6 standard colors (no custom Pantone matching required)

- 3 nipple flow rate options (slow/medium/fast therapeutic flows)

- 2 capacity configurations (10ml standard, 5ml micro-dose)

- Logo printing using existing pad printing setups

- Packaging variations from bulk poly bags to retail blister cards

This approach delivers 80% of custom product benefits at 30% of traditional custom tooling costs, making specialized solutions economically viable for smaller market segments.

Market Pain Point #4: The Quality Consistency Crisis in Long-Term Contracts

When “Approved Supplier” Status Becomes Worthless

Regional hospital purchasing cooperatives typically lock suppliers into 2-3 year contracts with strict quality specifications. However, distributors frequently discover that manufacturers meeting initial quality standards fail to maintain consistency across subsequent production runs.

The warning signs appear months into a contract:

- Batch 1: Perfect dimensional accuracy, smooth syringe operation

- Batch 4: Plunger resistance increases, measurement markings fade

- Batch 7: Silicone pacifiers show premature degradation

By the time quality drift becomes apparent, distributors face impossible choices: breach supply contracts or distribute substandard medical devices to vulnerable infant populations.

Root Causes of Manufacturing Quality Drift

Most quality failures in food catheter production stem from:

Raw Material Substitution: Manufacturers quietly switch from pharmaceutical-grade silicone to cheaper food-grade alternatives during high-volume production phases, degrading product performance while maintaining visual similarity.

Process Shortcuts: As factories prioritize throughput to meet large orders, critical steps like annealing cycles (preventing plastic stress fractures) or secondary cleaning protocols get abbreviated or skipped.

Inspection Fatigue: Initial production runs receive thorough QC attention, but as the “routine” nature of repeat orders sets in, inspection rigor deteriorates.

Triple-Layer Quality Architecture

Solving the consistency problem requires systemic manufacturing controls, not just spot-check inspections. Advanced food syringe suppliers implement three quality gates:

Gate 1 – Material Verification (Pre-Production) Every incoming shipment of silicone, polypropylene, and packaging materials undergoes SGS certification matching. Spectroscopy testing confirms chemical composition matches approved specifications before materials enter production floor.

Gate 2 – In-Process Monitoring (During Manufacturing) Three automated checkpoints during assembly:

- Post-molding dimensional scanning (rejects out-of-tolerance parts before assembly)

- Pacifier attachment force testing (prevents detachment hazards)

- Graduated marking legibility verification (ensures dosing accuracy)

Gate 3 – Pre-Shipment Validation (100% Final Inspection) Rather than statistical sampling, every finished unit undergoes functional testing: plunger operation smoothness, leak resistance under pressure, and visual defect screening. This comprehensive approach catches quality drift before products reach customers.

Market Pain Point #5: The Lead Time Trap in Seasonal Demand Cycles

Missing the Market Window

Cold and flu season drives 60-70% of annual infant medicine dispenser sales in most markets. Distributors who can’t secure inventory by September lose the critical Q4 revenue opportunity that funds entire business operations.

Yet standard manufacturing lead times create impossible timelines:

- Standard production: 25-35 days

- Ocean freight: 30-45 days

- Customs clearance: 7-14 days

- Domestic distribution: 5-10 days

Total timeline: 67-104 days from order to shelf availability

An order placed in July might not reach retail partners until November—after peak season demand has already passed.

Strategic Inventory Management Solutions

Sophisticated distributors working with flexible manufacturing partners implement hybrid supply strategies:

Base Stock + Rapid Customization Model

Manufacturers maintain inventory of completed catheter for food syringe units in neutral packaging. When distributor orders arrive, only final customization steps occur:

- Logo pad printing (2-3 days)

- Custom label application (1 day)

- Branded packaging assembly (2 days)

- Express shipping (4-6 days)

This approach reduces lead time to 9-12 days for urgent replenishment orders while maintaining brand customization.

Consignment Warehousing Arrangements

For distributors with predictable annual volume (150,000+ units across multiple SKUs), some manufacturers offer consignment models:

- Factory maintains agreed inventory level at international warehouse

- Distributor draws against inventory as needed with 7-day fulfillment

- Quarterly true-up payments based on actual consumption

- Eliminates upfront capital requirements while ensuring supply security

Real-World Success Story: Regional Therapy Clinic Network

Challenge: A network of 47 pediatric therapy clinics across the Southeastern US needed specialized feeding syringes for children with cerebral palsy and Down syndrome. Their patients required slower flow rates and longer catheter tips than retail products offered, but total annual demand (35,000 units) fell below most manufacturers’ minimums.

Solution: Partnering with a 50,000 MOQ manufacturer offering modular customization:

- Selected slow-flow therapeutic nipple variant

- Added extended 2cm catheter tip for oral positioning

- Custom labeled with clinic network branding

- Split delivery: 25,000 units initially, 25,000 units 6 months later

Results:

- 92% patient compliance improvement vs. standard feeding tools (per therapist surveys)

- $47,000 annual cost savings vs. assembling improvised solutions from retail parts

- New revenue stream: Selling excess inventory to other therapy networks created $23,000 in unexpected income

- Brand differentiation: Proprietary feeding system became competitive recruiting advantage for attracting specialized therapists

The clinic network’s success demonstrates how targeted food catheter customization creates value far exceeding the incremental product cost.

Critical Specifications for Medical-Grade Feeding Systems

Beyond Basic “Food Safe” Standards

When evaluating potential food syringe suppliers for medical applications, verify these technical capabilities:

Material Specifications:

- Medical-grade silicone (USP Class VI or higher)

- Polypropylene rated for autoclave sterilization (120°C minimum)

- Zero BPA, phthalates, PVC per CPSIA requirements

- Extractables testing for common medications (antibiotics, pain relievers)

Functional Performance:

- Plunger force consistency: ±10% across 5,000 operation cycles

- Measurement accuracy: ±0.2ml deviation across graduated range

- Leak resistance: Zero fluid loss under 15 PSI pressure

- Pacifier attachment strength: Withstands 20N pull force

Manufacturing Process Controls:

- ISO 13485 medical device quality management certification

- Clean room assembly (ISO Class 8 minimum for final assembly)

- Validated sterilization protocols (EtO or gamma radiation)

- Traceability systems linking lot codes to raw material batches

These specifications separate medical-grade catheter for food systems from consumer-grade baby products.

The Financial Case for Custom vs. Off-the-Shelf Solutions

Total Cost of Ownership Analysis

Many distributors initially gravitate toward off-the-shelf products assuming lower cost. However, comprehensive TCO analysis reveals custom solutions often deliver superior economics:

Off-the-Shelf Product:

- Unit cost: $1.85

- But: 23% return rate due to poor special-needs fit

- Effective cost after returns: $2.40 per sellable unit

- No brand differentiation = razor-thin margins (12-15%)

- Limited to general retail channels

Custom Food Syringe (50K MOQ):

- Unit cost: $2.10

- Return rate: 4% (properly designed for application)

- Effective cost: $2.19 per sellable unit

- Brand differentiation enables 35-40% margins

- Access to premium medical supply channels

The custom food syringe solution delivers 9% lower effective cost while commanding 2.5x higher margins—a financial transformation that funds business growth and market expansion.

Conclusion: Turning Market Gaps Into Competitive Advantage

The specialized infant feeding market remains fragmented and underserved because most manufacturers chase high-volume, low-complexity retail products. For distributors willing to understand the unique needs of special populations—premature infants, post-surgical patients, therapy-dependent children—this creates extraordinary opportunity.

The key success factors:

✅ Partner with flexible manufacturers offering 50,000-unit minimums rather than mega-scale MOQs

✅ Prioritize compliance infrastructure over lowest unit cost—regulatory failures destroy businesses

✅ Invest in modular customization that serves niche needs without custom tooling expenses

✅ Demand comprehensive quality systems maintaining consistency across multi-year contracts

✅ Structure supply agreements supporting seasonal demand and rapid market response

The distributors who will dominate specialized pediatric care markets over the next decade aren’t those with the lowest prices—they’re those delivering precisely engineered food catheter systems that medical professionals can rely on for their most vulnerable patients.

Next Steps: Evaluating Your Custom Product Opportunity

Is your market ready for specialized feeding solutions? Ask yourself:

- Do hospitals or specialty clinics in your region report challenges with standard infant feeding products?

- Are therapy networks or special needs organizations seeking better medical feeding tools?

- Can you identify 3+ customer segments needing different flow rates, capacities, or catheter designs?

- Does your annual volume potential exceed 35,000 units across specialized applications?

If you answered “yes” to two or more questions, custom food syringe solutions likely represent a high-potential expansion opportunity for your distribution business.

The special needs infant feeding market isn’t just underserved—it’s actively seeking distributors who understand that one size truly doesn’t fit all when caring for our most vulnerable children.