When we examine the staggering $16.3 billion global disposable syringe market in 2024, it’s challenging to envision that this seemingly straightforward medical device is undergoing unprecedented technological transformation. What’s even more compelling is that the global disposable syringe market is expanding at a robust 6.3% CAGR, projected to achieve substantial growth by 2033. This steady expansion reflects the healthcare industry’s relentless pursuit of enhanced safety, efficiency, and cost control.

Historical Perspective: The Paradigm Shift from Glass to Plastic

The evolution of syringes mirrors the broader trajectory of medical technology advancement. From mid-19th century glass syringes to the revolutionary invention of disposable plastic syringes in the 1960s, each breakthrough emerged from urgent needs for infection control and medical safety. The true watershed moment occurred in the 1990s when the HIV/AIDS epidemic triggered profound reflection on cross-contamination risks associated with medical devices.

This historical context provides crucial insight into today’s market landscape. The 89.23% market share dominated by disposable syringes in 2024 isn’t coincidental. Healthcare facilities’ standardized adoption of single-use devices stems from overwhelming evidence linking reusable syringes to cross-infection risks. This transition represents more than technological progress—it’s a fundamental shift in the healthcare industry’s risk management philosophy.

Current Market Dynamics: The Dominance of Safety Syringes

Analyzing the current market structure reveals a striking trend: safety syringes captured approximately 80.9% of the market share in 2024. This statistic reflects the healthcare industry’s unprecedented focus on needlestick injury prevention.

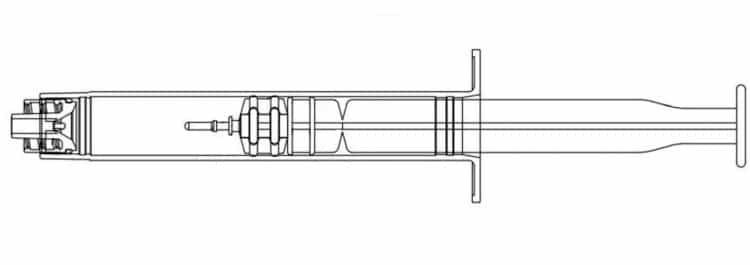

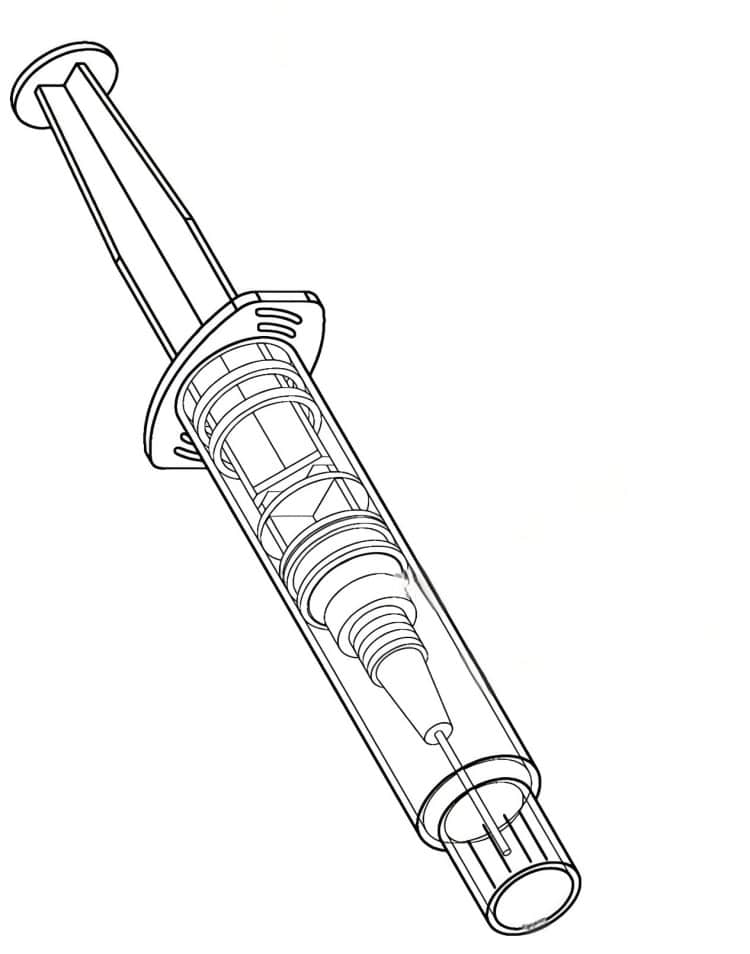

The market dominance of safety syringes stems from a fundamental shift in design philosophy. Traditional syringe design prioritized functionality and cost-effectiveness, while safety syringes place healthcare worker occupational safety at the forefront. This philosophical transformation has catalyzed widespread adoption of innovative technologies including auto-retractable needles, retractable needle protection sheaths, and passive safety mechanisms.

More significantly, the safety syringe segment is projected to reach $15 billion by 2030, with a 6.8% CAGR. This growth rate substantially exceeds the 4.6% growth rate of conventional syringes, indicating the market is experiencing structural upgrading, with safety becoming the core driver of product innovation and market expansion.

US and European Market Analysis: The Dual Engine of Regulatory Compliance and Innovation

The US and European markets hold pivotal positions in the global disposable syringe industry, with their status formed through unique regulatory environments and technological innovation capabilities.

In the North American market, the syringe-related medical device market reached $645.1 million in 2024, projected to reach $1.04 billion by 2030. This growth is primarily driven by rising chronic disease prevalence, as chronic condition management often requires long-term, frequent injection therapy, providing a stable demand foundation for the disposable syringe market.

Another distinctive feature of US and European markets is stringent safety standard requirements. OSHA’s (Occupational Safety and Health Administration) Needlestick Safety and Prevention Act and the EU’s Medical Device Regulation (MDR) impose mandatory requirements for safety syringe applications. This regulatory environment not only drives safety syringe technology development but also creates technological barriers for related companies, forming competitive advantages.

Global Supply Chain Restructuring: The New Balance of Geopolitics and Industrial Layout

The COVID-19 pandemic exposed vulnerabilities in global medical supply chains while accelerating supply chain restructuring. In the disposable syringe sector, this restructuring manifests as production base diversification and supply chain regionalization.

Traditionally, Asia, particularly China, has been the primary global disposable syringe manufacturing hub, leveraging cost advantages and manufacturing capabilities to occupy significant market positions. However, supply chain disruptions during the pandemic prompted US and European countries to reassess the risks of over-reliance on single supply sources. This reflection has spawned concepts of “nearshoring” and “friendshoring,” driving regionalized supply chain layouts.

From an industrial development perspective, supply chain restructuring provides new opportunities for technological innovation. Companies no longer pursue pure cost minimization but increasingly focus on supply chain resilience and responsiveness. This shift drives development in automated production technology, smart manufacturing, and digital supply chain management, creating conditions for disposable syringe industry technological upgrades.

Technology Innovation Drivers: The Leap from Functionality to Intelligence

Current disposable syringe technology innovation demonstrates diversified trends, primarily reflected in the convergence of materials science, design engineering, and digital technology.

In materials innovation, biodegradable materials applications are transforming the environmental impact of traditional plastic syringes. Novel polymer materials not only provide superior biocompatibility but also achieve environmental sustainability while maintaining functionality. This innovation responds to growing global environmental protection concerns while creating new market opportunities for companies.

Design engineering innovation concentrates on safety and usability enhancements. Applications of programmable dose control, tamper-evident design, and smart identification systems are transforming traditional passive medical devices into active medical assistance tools. This transformation not only improves medical safety but also lays the foundation for precision medicine development.

Digital technology integration may represent the most revolutionary innovation direction. BD’s partnership with ten23 health in March 2024 utilizes RFID technology to develop tracking methods for pre-filled syringes. This technological innovation not only enables full lifecycle product tracking but also provides new avenues for medical data collection and analysis.

Market Driver Analysis: Structural Changes in Demand

The driving factors propelling disposable syringe market growth are undergoing profound changes, transitioning from traditional population growth and healthcare demand expansion toward more complex, diversified driving patterns.

Rising lifestyle-related health issues such as cardiovascular disease and obesity have become important market growth drivers. Managing these chronic diseases often requires long-term pharmaceutical therapy, with many novel drugs, particularly biologics, requiring injection administration. This demand structure change not only drives disposable syringe market volume growth but also promotes product technology upgrades.

Growing vaccination demand represents another crucial driving factor. The COVID-19 pandemic not only created enormous short-term demand but also heightened global awareness of vaccination importance. This awareness shift will provide long-term demand support for the disposable syringe market.

Additionally, emerging market healthcare infrastructure development and improved healthcare service accessibility provide new growth opportunities. As global health governance systems improve, more regions will establish standardized healthcare service systems, directly driving disposable syringe demand growth.

Competitive Landscape Evolution: From Price Competition to Value Creation

The disposable syringe market competitive landscape is experiencing a transition from price-oriented to value-oriented competition. Traditional cost-competition models are being replaced by technological innovation, quality enhancement, and service optimization.

The fundamental reason for this shift lies in the healthcare industry’s continuously rising product quality and safety requirements. Healthcare institutions increasingly prioritize total cost of ownership over pure procurement prices in purchasing decisions. This change creates greater competitive advantages for technology-leading companies while driving industry-wide technological upgrades.

Increasing market concentration represents another important trend. Major companies continuously expand market share through technological innovation, brand building, and channel optimization. Simultaneously, through mergers and acquisitions, industry resources further concentrate toward advantaged companies. This concentration trend benefits technological innovation acceleration and industrial efficiency improvement.

Future Development Trends: Five Core Directions

Based on current market landscape and technology development trend analysis, we can foresee five core directions for future disposable syringe industry development:

Smart Integration will become the dominant product development direction. Applications of Internet of Things (IoT) technology, artificial intelligence, and big data analytics will transform disposable syringes from simple drug delivery tools into intelligent medical devices. This transformation not only improves medical safety and efficiency but also provides new pathways for medical data collection and analysis.

Personalized Customization will respond to precision medicine development needs. Customized syringe designs based on individual patient differences will become an important future product innovation direction. This customization includes not only dose control and administration method personalization but also device appearance and operation method personalization.

Environmental Sustainability will become an important product design consideration. Applications of biodegradable materials, packaging optimization, and recycling technology development will effectively reduce product environmental impact. This sustainable design not only meets environmental requirements but also creates new market opportunities for companies.

Safety Enhancement will continue driving technological innovation. Development of needlestick injury prevention, drug contamination protection, and user error prevention safety technologies will further improve product safety performance. This safety enhancement not only protects healthcare workers and patients but also creates technological barriers for companies.

Cost-Effectiveness Optimization will be achieved through technological innovation and economies of scale. Applications of automated production technology, supply chain optimization, and product standardization will effectively reduce product costs and improve market competitiveness.

Challenges and Opportunities in Development Prospects

The disposable syringe industry is expected to experience substantial growth, with projected market value of $7.2 billion in 2024 and a robust 6.15% CAGR during the 2024-2034 forecast period. This growth expectation reflects market optimism about industry development prospects, but also requires rational consideration of potential challenges in the development process.

Regulatory environment complexity represents one of the primary challenges facing industry development. As safety standards continuously improve and regulatory requirements become increasingly stringent, companies must invest more resources in compliance management. While this regulatory pressure increases company costs, it also provides clear directional guidance for technological innovation.

Technology innovation uncertainty represents another significant challenge. New technology R&D involves long cycles, large investments, and high risks, requiring companies to possess strong technological capabilities and financial support. Simultaneously, successful technological innovation requires market acceptance and regulatory approval, adding complexity to innovation.

However, these challenges also harbor tremendous development opportunities. For companies with technological advantages and innovation capabilities, the current market environment provides unprecedented development opportunities. Technological innovation not only creates competitive advantages but also opens new market spaces.

Conclusion: Embracing the Era of Transformational Opportunities

The development prospects for innovative disposable syringe products are promising yet challenging. The global syringe market reached $24.59 billion in 2024, projected to reach $59.39 billion by 2034, with a 9.22% CAGR. This robust growth reflects the healthcare industry’s enormous demand for innovative products.

In this transformational era, successful companies will be those that can accurately grasp technology development trends, deeply understand market demand changes, and effectively respond to regulatory challenges. Through continuous technological innovation, precise market positioning, and efficient operational management, these companies will occupy advantageous positions in future market competition.

For the entire industry, innovative disposable syringe development represents not only technological progress but also the elevation of medical safety concepts and healthcare service quality improvement. This development will make significant contributions to global healthcare advancement while creating greater value for human health endeavors.

Key Takeaways:

- Market Size: Global disposable syringe market valued at $16.3 billion in 2024

- Growth Rate: 6.3% CAGR projected through 2033

- Market Share: Safety syringes dominate with 80.9% market share

- Technology Focus: Smart integration, biodegradable materials, and RFID tracking

- Regional Markets: North America projected to reach $1.04 billion by 2030

- Innovation Drivers: Chronic disease management, vaccination programs, and precision medicine