The global healthcare industry stands at a critical juncture. As medical demand surges worldwide, the spotlight has turned to syringe manufacturers in China, whose production capabilities have become integral to international medical supply chains. Understanding this landscape is essential for healthcare buyers, distributors, and medical professionals navigating today’s complex procurement environment.

The Global Syringe Market: Growth Trajectory and Emerging Trends

The worldwide syringe industry represents a cornerstone of medical infrastructure, with market projections indicating substantial growth from approximately $26-30 billion in 2025 to significantly higher valuations by 2030. This expansion, driven by chronic disease management and widespread vaccination programs, reflects the fundamental shift in global healthcare delivery.

Key Market Dynamics

Disposable Syringes Maintain Dominance: Single-use syringes continue to command the largest market share due to their cost-effectiveness and critical role in infection prevention. The demand for these medical disposable products remains robust across both developed and emerging markets.

Premium Segment Acceleration: Pre-filled syringes and safety-engineered devices are experiencing rapid growth, catering to home healthcare scenarios and advanced vaccination programs. These sophisticated products represent the industry’s evolution toward higher-value manufacturing.

Technology-Driven Transformation

The sector is transitioning from volume-based expansion to value-driven innovation:

- Smart Design Integration: Safety features like needle-stick prevention mechanisms and precision dosage control systems are becoming standard expectations rather than premium options.

- Sustainable Manufacturing: Research into biodegradable polymers and eco-friendly materials, including PLA-based alternatives, addresses growing environmental concerns in medical waste management.

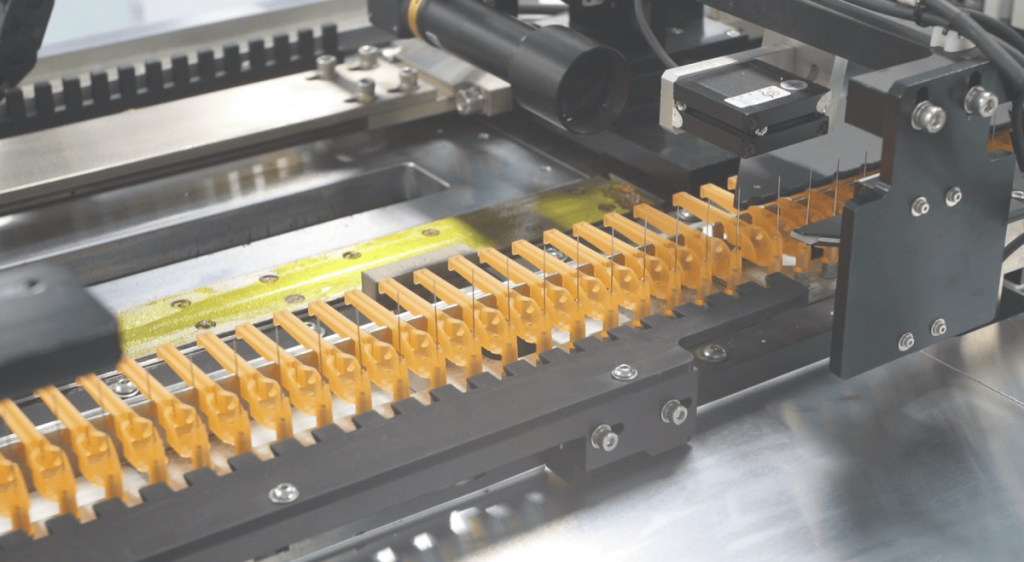

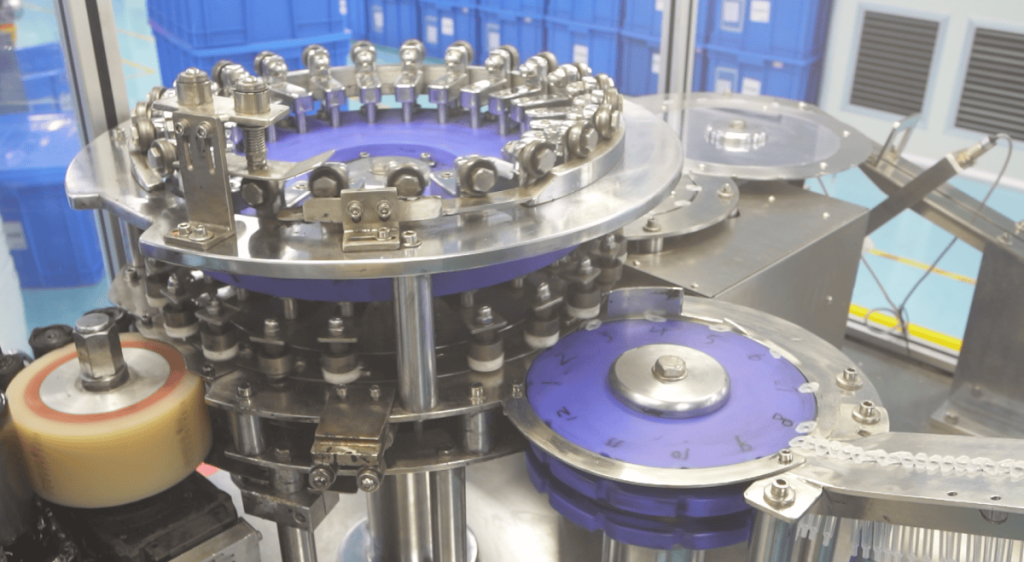

- Automation Excellence: High-speed automated production lines are revolutionizing manufacturing efficiency, reducing labor costs while improving quality consistency.

China’s Strategic Position in Global Syringe Production

When discussing any syringe manufacturer of significance, China’s manufacturing ecosystem cannot be overlooked. The nation has established itself as a dominant force in global medical device production, particularly in injection technology.

Production Capacity and Market Share

Industry analyses consistently identify China as one of the world’s largest syringe manufacturing hubs. Historical data suggests Chinese-manufactured disposable syringes and needles have captured substantial global market share—reports from recent years indicated figures approaching 90% in certain product categories. This commanding presence reflects decades of strategic investment in medical device infrastructure.

Manufacturing Capabilities: Strengths and Development Areas

Core Competencies: Chinese manufacturers excel in standard disposable syringes and basic safety-engineered products, with mature production lines capable of meeting global demand volumes. Their expertise in mid-tier manufacturing has made quality medical supplies accessible to healthcare systems worldwide.

Innovation Frontiers: The industry continues advancing in several high-value segments:

- Advanced safety injection systems and needle-free delivery mechanisms remain areas where international technology leaders maintain advantages

- Precision pre-filled syringes requiring ultra-fine tolerances represent ongoing development priorities

- High-precision molds and advanced automated equipment for premium products still partially rely on German and Japanese engineering expertise

Supply Chain Integration

China’s role extends beyond manufacturing to encompass broader supply chain functions. Medical-grade plastics (polyethylene and polypropylene) and essential components increasingly source from domestic suppliers, strengthening supply chain resilience. However, certain specialty materials and high-end components continue to require international procurement, highlighting areas for continued development.

This positioning establishes Chinese manufacturers as critical nodes in the global healthcare supply network, balancing volume production capabilities with ongoing technological advancement.

Navigating Trade Complexities: Understanding and Overcoming Procurement Challenges

For American and European buyers sourcing from syringe manufacturers in China, the procurement landscape presents considerations that require strategic planning—but these are far from insurmountable barriers. In fact, thousands of healthcare organizations successfully navigate these factors daily, accessing China’s manufacturing capabilities while maintaining compliance and quality standards.

Trade Policy and Tariff Considerations

Recent years have seen evolving trade dynamics affecting medical device sectors:

United States: Tariff policies on certain Chinese imports require buyers to factor duty costs into procurement planning. However, experienced importers and customs brokers routinely optimize classifications and leverage available exemptions, particularly for essential medical supplies. Many healthcare buyers find that even with tariffs, total landed costs remain highly competitive compared to domestic alternatives—when such alternatives exist at all.

European Union: While the EU has implemented some trade measures, qualified manufacturers with proper CE certification continue to access European markets successfully. The key lies in working with suppliers who understand and maintain compliance with EU regulatory requirements.

Practical Reality: Major hospital groups, pharmaceutical companies, and medical distributors worldwide continue robust sourcing from China, demonstrating that these policy considerations are manageable within professional procurement frameworks. The existence of tariffs doesn’t eliminate cost advantages—it simply requires informed planning.

Regulatory Compliance: A Differentiator, Not a Barrier

Western markets maintain rigorous medical device standards—which actually benefits buyers by ensuring quality:

FDA Requirements: Yes, the U.S. Food and Drug Administration mandates comprehensive certification for medical disposable products. However, established Chinese manufacturers have successfully obtained and maintained FDA registrations for years. These certifications aren’t theoretical possibilities—they’re operational realities at quality-focused facilities.

EU MDR Compliance: Similarly, European Union Medical Device Regulation requirements are stringent, but numerous Chinese manufacturers hold valid CE marks and undergo regular European Notified Body audits. These suppliers offer the same regulatory assurance as European manufacturers.

The Buyer Advantage: Rather than viewing regulations as obstacles, smart buyers recognize them as qualification filters. A syringe manufacturer with current FDA registration and ISO 13485 certification has already demonstrated commitment to international quality standards—providing buyers with confidence and legal protection.

Supply Chain Management: Mature and Reliable

Modern logistics and supply chain management have largely addressed traditional concerns:

Cost Predictability: While raw material prices fluctuate globally (affecting all manufacturers regardless of location), experienced Chinese suppliers offer fixed-price contracts and transparent pricing structures. Many also maintain strategic inventory specifically for international customers, buffering against short-term volatility.

Logistics Excellence: Decades of export experience have created sophisticated shipping networks, with established Chinese suppliers offering:

- Regular container shipping schedules with predictable transit times

- Air freight options for urgent requirements

- Warehousing partnerships in major Western markets for faster delivery

- Track-and-trace systems providing real-time shipment visibility

Supply Reliability: The track record speaks clearly: major pharmaceutical companies, hospital groups, and medical distributors rely on Chinese manufacturers for consistent, high-volume supply. This trust comes from proven performance, not theoretical capability.

Addressing Localization Policies Strategically

While some governments promote domestic production, market realities create practical limitations:

Capacity Gaps: Government incentives can’t instantly create the manufacturing capacity, expertise, and infrastructure that China has developed over decades. Healthcare buyers facing immediate needs cannot wait years for theoretical domestic alternatives.

Market Segmentation: Public procurement may favor local suppliers where available, but private healthcare markets, distributors, and export-oriented businesses operate under different dynamics. Additionally, many “domestic” medical device companies actually source components or finished products from qualified Chinese manufacturers—a testament to the industry’s integration.

Hybrid Approaches: Smart buyers often maintain relationships with multiple suppliers across regions, using Chinese manufacturers for volume production while potentially using regional sources for specialized applications. This balanced approach provides both cost efficiency and supply security.

Why Global Buyers Turn to China: Bridging the Supply-Demand Gap

Domestic Production Limitations in Western Markets

A fundamental reality shapes global medical device procurement: most countries cannot meet their own syringe demand through domestic production alone. This supply-demand imbalance has made international sourcing not just economically attractive, but operationally essential.

Production Capacity Constraints: The United States, European nations, and other developed markets face significant limitations in domestic syringe manufacturing capacity. Building and maintaining the infrastructure required for high-volume medical device production demands substantial capital investment, specialized expertise, and economies of scale that many markets simply cannot justify.

Cost Competitiveness: Even countries with domestic manufacturing capabilities often find local production costs 2-3 times higher than imports. For healthcare systems facing budget pressures and the mandate to maximize patient care resources, this cost differential becomes impossible to ignore.

Speed to Market: Establishing new manufacturing facilities domestically can require 3-5 years for regulatory approval, construction, and validation. In contrast, qualified Chinese manufacturers offer immediate production capacity, enabling healthcare buyers to respond rapidly to demand fluctuations or emergency situations.

The Strategic Advantage of Chinese Sourcing

For pragmatic healthcare buyers, partnering with qualified syringe manufacturers in China offers compelling strategic benefits:

Unmatched Scale and Flexibility: Chinese manufacturers operate production facilities capable of producing billions of units annually, with the flexibility to scale production up or down based on seasonal demand or emergency requirements. This capacity simply doesn’t exist elsewhere at comparable scale.

Comprehensive Product Range: From basic disposable syringes to advanced safety-engineered devices, Chinese manufacturers offer the full spectrum of medical disposable products. This breadth enables buyers to consolidate suppliers, streamline procurement processes, and negotiate better terms through volume relationships.

Established Quality Infrastructure: Leading Chinese manufacturers have invested heavily in international certifications (FDA, CE Mark, ISO 13485) and quality management systems. Many facilities match or exceed the standards of Western manufacturers, having been audited by major international healthcare organizations and pharmaceutical companies.

Supply Chain Maturity: Decades of export experience have created sophisticated logistics networks, quality control systems, and customer service capabilities specifically designed for international healthcare buyers. This infrastructure reduces procurement risk and ensures reliable delivery.

Innovation Capacity: As Chinese manufacturers advance up the value chain, they’re increasingly capable of custom product development, private labeling, and technical collaboration—services traditionally associated only with Western suppliers.

Real-World Sourcing Success: Best Practices

Healthcare organizations worldwide have developed effective strategies for leveraging Chinese manufacturing capabilities:

Partnership Approach: Rather than viewing Chinese suppliers as interchangeable commodity providers, successful buyers develop strategic partnerships with qualified manufacturers. This approach yields better communication, priority treatment during capacity constraints, and collaborative problem-solving.

Quality as Non-Negotiable: The most successful procurement programs establish clear quality standards from the outset, conduct regular facility audits, and maintain ongoing quality monitoring. This diligence ensures that cost advantages never come at the expense of patient safety.

Regulatory Due Diligence: Buyers verify that their chosen syringe manufacturer maintains current regulatory certifications for their target markets, understanding that compliant suppliers provide both quality assurance and legal protection.

Supply Chain Transparency: Forward-thinking buyers work with manufacturers who provide visibility into raw material sourcing, production scheduling, and logistics planning. This transparency enables better inventory management and contingency planning.

Strategic Considerations for Healthcare Buyers

Due Diligence Framework

Successful procurement from Chinese syringe manufacturers requires comprehensive evaluation:

- Regulatory Verification: Confirm current FDA, CE, or other relevant certifications with independent verification

- Quality System Assessment: Evaluate ISO 13485 compliance and manufacturing process controls

- Supply Chain Transparency: Understand raw material sourcing and potential vulnerability points

- Financial Stability: Assess manufacturer financial health to ensure long-term partnership viability

Risk Mitigation Strategies

Dual Sourcing: Maintain relationships with multiple qualified suppliers across different geographic regions to mitigate concentration risk.

Long-Term Partnerships: Develop strategic relationships rather than transactional procurement approaches, enabling better communication and quality consistency.

Tariff Planning: Work with customs brokers and trade advisors to optimize import classifications and duty management.

Quality Agreements: Establish detailed quality agreements with clear specifications, testing protocols, and dispute resolution mechanisms.

The Future Landscape: Opportunities Amid Complexity

The global syringe manufacturing sector presents a paradox of opportunities and challenges:

| Dimension | Current Reality |

|---|---|

| Market Growth | Sustained expansion driven by healthcare access improvements and aging populations |

| Technology Evolution | Accelerating innovation in smart devices, sustainable materials, and automation |

| China’s Role | Critical production center advancing from volume provider toward value-added manufacturer |

| Procurement Challenges | Trade tensions, regulatory complexity, supply chain sensitivity, and localization pressures |

Emerging Opportunities

For qualified manufacturers demonstrating regulatory compliance and quality excellence, the market outlook remains robust. The intersection of growing global demand and increasing quality standards creates opportunities for manufacturers who can navigate compliance complexity while maintaining cost competitiveness.

Innovation Investment: Manufacturers investing in advanced safety features, sustainable materials, and smart technology will capture premium market segments.

Compliance Excellence: Suppliers who achieve and maintain Western regulatory certifications differentiate themselves in increasingly quality-conscious markets.

Supply Chain Resilience: Manufacturers building transparent, diversified supply chains address buyer concerns about reliability and business continuity.

Conclusion: China as a Strategic Solution for Global Healthcare Supply

The global syringe manufacturing landscape reveals a clear reality: syringe manufacturers in China are not merely an alternative to domestic production—they are an essential solution to global healthcare supply challenges. With most countries unable to meet their own medical device needs domestically, strategic sourcing from qualified Chinese manufacturers has become fundamental to healthcare delivery worldwide.

The equation is straightforward: growing global demand, limited domestic production capacity, and cost pressures on healthcare systems make international procurement inevitable. The question is not whether to source internationally, but how to do so strategically.

China offers unique advantages in this context:

- Production capacity that exceeds what most individual markets can develop domestically

- Cost efficiency that enables healthcare systems to allocate more resources to patient care

- Product diversity spanning basic disposables to advanced safety-engineered devices

- Quality infrastructure meeting international standards through certified facilities

- Supply chain maturity built through decades of global healthcare partnerships

For healthcare buyers and distributors, success lies in recognizing that sourcing medical disposable products from China is not about accepting compromises—it’s about accessing capabilities that enable better healthcare delivery. The manufacturers who have earned international certifications, invested in quality systems, and built transparent operations provide solutions that many domestic alternatives simply cannot match in terms of scale, cost, or availability.

The Path Forward

Smart procurement strategies embrace several principles:

Strategic Partnership Development: Build relationships with manufacturers who demonstrate commitment to quality, compliance, and long-term collaboration rather than transactional lowest-price bidding.

Quality-First Approach: Insist on international certifications, conduct facility audits, and maintain ongoing quality monitoring to ensure patient safety remains paramount.

Risk-Balanced Sourcing: While diversification has merit, recognize that qualified Chinese manufacturers often provide more reliable supply than attempting to source from markets with limited production capacity.

Informed Decision-Making: Understand that trade policies, tariffs, and regulatory requirements exist, but qualified manufacturers and experienced buyers navigate these successfully every day.

The healthcare organizations thriving in today’s environment are those who recognize that qualified Chinese manufacturing partners offer not just cost savings, but strategic capabilities essential to meeting patient needs reliably and sustainably. As healthcare demand continues growing globally while domestic production capacity remains limited, the importance of these partnerships will only increase.

Whether you’re sourcing for a regional health system, building a distribution network, or managing procurement for a national healthcare program, understanding China’s role as a solution provider—not merely a supplier—transforms procurement from a cost center into a strategic advantage.

The future of global healthcare supply depends on smart partnerships that leverage China’s manufacturing strengths while maintaining uncompromising standards for quality and compliance. This balance is not just achievable—it’s already being demonstrated by successful healthcare organizations worldwide.

For healthcare organizations ready to develop strategic sourcing partnerships with qualified Chinese manufacturers, success begins with understanding that in today’s global market, China doesn’t represent a compromise—it represents a solution to supply challenges that domestic alternatives cannot address at comparable scale, cost, or reliability. Visit our comprehensive product catalog to explore quality medical disposables manufactured to international standards, or learn more about our manufacturing capabilities and commitment to healthcare excellence.