As a newcomer to the prefilled syringe procurement industry in the US or EU markets, sourcing and customizing products from China presents a complex array of challenges. These obstacles span everything from quality standard discrepancies and regulatory compliance to supply chain management intricacies.

Common Problem Summary:

New buyers typically encounter the following critical concerns:

How can you ensure Chinese suppliers meet stringent FDA/EMA medical device standards?

How do you accurately communicate customization requirements (such as glass material selection, siliconization treatment, needle gauge specifications)?

How do you handle cash flow pressure from excessive Minimum Order Quantities (MOQ)?

How do you align quality control standards for sterility testing, particulate contamination, and seal integrity testing?

How do you resolve intellectual property protection and mold ownership disputes?

How do you manage project delays caused by extended lead times, time zone differences, and language barriers?

How do you mitigate risks of quality inconsistency between sample validation and mass production?

How do you control temperature-sensitive logistics and breakage rates during transportation?

How do you navigate payment method trust issues (T/T advance payment vs. Letters of Credit)?

And how do you verify suppliers’ actual production capabilities and the legitimacy of their certifications?

Mishandling these issues can lead to project failure, product recalls, or even legal disputes. Below, we’ll systematically categorize these problems and provide actionable solutions.

I. Quality Standards & Regulatory Compliance Issues

1.1 Regulatory Certification Gaps

Core Problems:

- Chinese suppliers claim ISO 13485 certification but lack understanding of FDA 21 CFR Part 820 QSR or EU MDR 2017/745 specific requirements

- Insufficient knowledge of USP (United States Pharmacopeia) and EP (European Pharmacopoeia) standards for prefilled syringes

- Limited experience preparing DMF (Drug Master File) or CEP (Certificate of Suitability) documentation

Solutions:

- Pre-Qualification Audits: Require suppliers to provide complete quality management system documentation, including SOPs, validation reports, and audit records

- Third-Party Certifications: Prioritize factories with FDA registration, CE marking, or documented US/EU customer audit records

- Regulatory Consultants: Engage consultants experienced in US-China/EU-China medical device regulations for supplier audits

- Contract Clauses: Explicitly state suppliers must maintain continuous compliance with target market regulations and assume liability for non-compliance

1.2 Quality Control Standard Discrepancies

Core Problems:

- Sterility testing standards: Methodological differences between Chinese GB standards and USP/EP

- Visible/sub-visible particle testing: Divergent interpretations of AQL sampling standards

- Siliconization layer quality: Inconsistent standards for silicone oil migration testing and glide force testing

- Different sensitivity requirements for leak testing

Solutions:

- Detailed Technical Specifications: Develop comprehensive technical documentation including all Critical Quality Attributes (CQA) with explicit test methods and acceptance criteria

- Joint Validation: Conduct IQ/OQ/PQ validation at supplier facilities to ensure test equipment and methods meet US/EU standards

- Third-Party Testing: Send critical batches to international laboratories like SGS or Eurofins for independent verification

- On-Site Quality Representatives: Deploy QA personnel for on-site supervision during critical production phases

II. Customization Communication Challenges

2.1 Technical Specification Miscommunication

Core Problems:

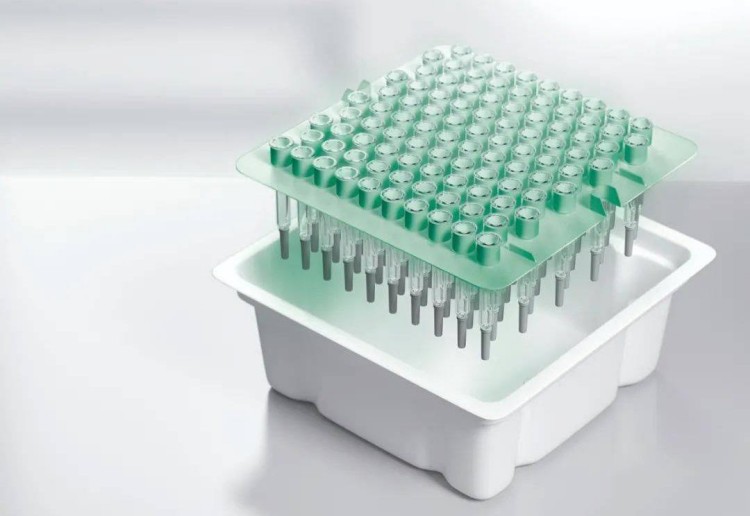

- Glass type selection (Type I neutral glass vs. borosilicate glass) and drug compatibility considerations inadequately communicated

- Siliconization method (spray siliconization vs. baked siliconization) impacts on glide force not mutually understood

- Needle type (regular bevel vs. special bevel) and needle shield material special requirements

- Precision requirements and printing methods for graduation markings

Solutions:

- Standardized Engineering Drawings: Use ISO-standard engineering drawings with clearly marked tolerance ranges

- Physical Reference Samples: Provide actual competitor or target product samples as reference standards

- Technical Alignment Meetings: Organize multiple rounds of technical discussions between supplier engineering teams and your R&D team

- Milestone Confirmations: Establish written confirmations at key stages including Design Qualification (DQ) and Installation Qualification (IQ)

2.2 Customization Cost Management

Core Problems:

- High mold costs (single mold set can range from $30,000-$100,000) with unclear ownership terms

- Customization-driven excessive MOQ requirements (500,000-1 million units minimum)

- Lack of constraints on price fluctuations for subsequent orders

- Non-transparent design change fee calculations

Solutions:

- Clear Mold Clauses: Explicitly define mold ownership, custody period, and transfer conditions in contracts

- Tiered Pricing: Sign long-term agreements with volume-based tiered pricing structures

- Co-Development Agreements: For highly customized products, consider exclusive supply agreements to share development costs

- Multi-Supplier Mold Strategy: For non-proprietary designs, retain mold drawings to enable future alternative supplier options

III. Supply Chain Management Issues

3.1 Minimum Order Quantity (MOQ) Pressure

Core Problems:

- New product launch demand uncertainty, yet suppliers require 500,000+ unit MOQs

- Significant capital tie-up with high inventory obsolescence risk

- Prefilled syringe shelf life limitations (typically 2-3 years) creating inventory turnover pressure

Solutions:

- Phased Deliveries: Negotiate splitting large orders into multiple delivery batches to ease cash flow pressure

- Group Purchasing: Form purchasing consortiums with other small buyers to collectively meet MOQ

- Flexible Production Arrangements: Pay premium fees for smaller batch production flexibility

- Consignment Inventory: Negotiate VMI (Vendor Managed Inventory) arrangements where suppliers bear partial inventory burden

3.2 Lead Times & Production Scheduling

Core Problems:

- Extended first-order lead times (3-6 months for samples, plus 3-4 months for mass production)

- Production disruptions during Chinese New Year and National Day extended holidays

- Insufficient supplier capacity during demand surges

- Long and unstable ocean freight cycles (30-60 days)

Solutions:

- Advance Production Planning: Forecast demand and place orders 6-12 months ahead

- Holiday Planning: Research Chinese holiday schedules in advance and build buffer inventory

- Capacity Reservation Agreements: Sign capacity reservation agreements to guarantee emergency demand fulfillment

- Dual Sourcing Strategy: Develop backup suppliers to diversify risk

- Air Freight Contingency: Budget for air freight for critical orders

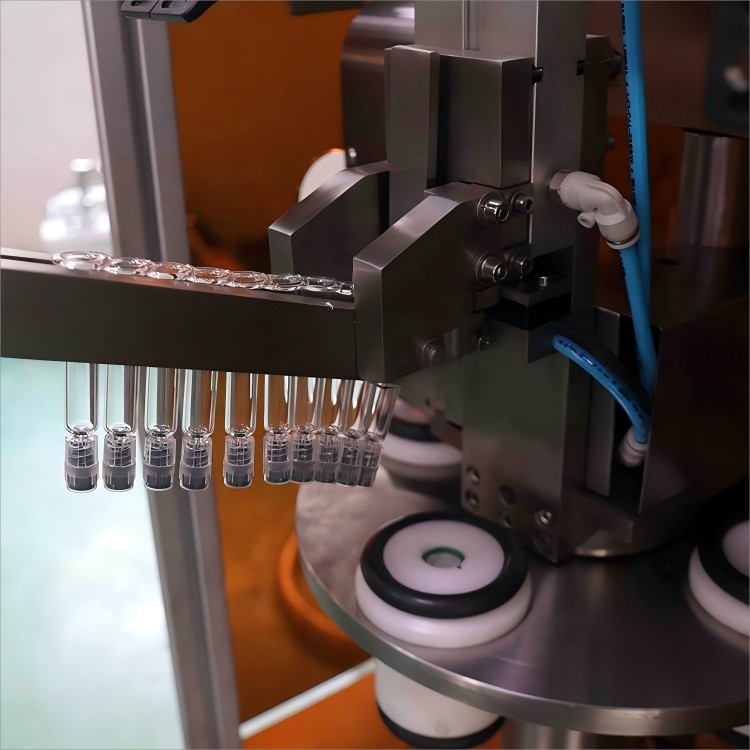

3.3 Logistics & Packaging

Core Problems:

- High glass syringe transportation breakage rates (potentially 2-5%)

- Strict temperature control requirements but inadequate container temperature monitoring

- Packaging incompatible with US/EU material handling equipment standards (pallet dimensions, stacking heights)

- Inadequate customs clearance documentation

Solutions:

- Packaging Testing: Require suppliers to conduct ISTA packaging transport testing

- Specialized Logistics Providers: Select freight forwarders with medical device cold chain experience

- Insurance Coverage: Purchase comprehensive insurance with clearly defined breakage liability

- Standardized Packaging: Provide US/EU standard pallet specifications and packaging requirements (e.g., 1200x800mm Euro pallets)

- Customs Documentation Checklist: Prepare templates for FDA Import Alerts, CE Declarations of Conformity, etc.

IV. Commercial & Trust-Building Issues

4.1 Payment Terms Disputes

Core Problems:

- Suppliers demand 30-50% advance payment, but buyers worry about quality risks

- Letters of Credit are expensive and operationally complex

- First-time collaborations lack trust foundation

- Unclear refund mechanisms for quality issues

Solutions:

- Staged Payments: 30% deposit + 40% upon production completion + 30% upon acceptance

- Third-Party Escrow: Use Escrow services for payment custody

- Flexible L/C Terms: Use transferable or confirmed Letters of Credit to reduce risk

- Quality Retention: Retain 5-10% as quality assurance deposit, payable 6 months after acceptance if no issues arise

- Small Trial Orders: Build trust through small initial orders

4.2 Intellectual Property Protection

Core Problems:

- Custom mold designs used by suppliers for other customers

- Technical drawings leaked to competitors

- Suppliers selling directly to your customers

- Patent infringement risks

Solutions:

- NDA Agreements: Sign strict Non-Disclosure Agreements with clear breach penalties

- Patent Searches: Conduct comprehensive patent searches before customization to avoid infringement

- Exclusivity Clauses: Include regional exclusivity provisions in contracts

- Legal Jurisdiction: Select Hong Kong or Singapore as arbitration venues for easier enforcement

- Distributed Manufacturing: Split critical components and assembly across different suppliers

4.3 Supplier Qualification Authenticity

Core Problems:

- Certificate fraud (fake ISO, fake FDA registration)

- Capacity misrepresentation (claiming 1 million units/month but actually capable of only 200,000 units/month)

- Using affiliated company certificates

- “Theatrical” performance during audits

Solutions:

- Certificate Verification: Directly verify certificate authenticity with issuing bodies

- On-Site Audits: Conduct mandatory surprise on-site audits to observe actual production

- Customer References: Request contact information for 3+ US/EU customers and verify

- Third-Party Background Checks: Commission professional firms for supplier background investigations

- Equipment Inventory Verification: Verify key equipment brands, models, and purchase invoices

V. Communication & Cultural Difference Issues

5.1 Language & Technical Terminology

Core Problems:

- Supplier limited English proficiency hampering technical detail communication

- Inaccurate medical device terminology translations

- Discrepancies between written communication and actual understanding

- Communication delays from time zone differences

Solutions:

- Bilingual Engineers: Staff your team with Chinese-speaking technical personnel

- Professional Translation: Hire medical device industry specialized translators

- Terminology Reference Tables: Create Chinese-English technical terminology concordances for unified language

- Video Conferencing: Hold regular video meetings to confirm critical information and avoid misunderstandings

- Confirmation Mechanisms: Require written confirmation with dual signatures for important decisions

5.2 Business Culture Differences

Core Problems:

- Different understandings of contract seriousness (Chinese suppliers tend toward “do first, discuss later”)

- Untimely problem feedback (tendency to report good news but not bad)

- Cultural differences in quality issue liability attribution

- Delivery commitment uncertainty

Solutions:

- Clarify Contract Binding Force: Explicitly state the legal binding force of each contract clause

- Regular Progress Reports: Require weekly/bi-weekly written progress reports

- Problem Escalation Mechanisms: Establish problem escalation procedures encouraging early issue disclosure

- On-Site Liaisons: Deploy your personnel for daily communication during critical phases

- Cultural Training: Provide cross-cultural communication training for both teams

VI. Quality Consistency & Batch Management Issues

6.1 Sample vs. Mass Production Discrepancies

Core Problems:

- Excellent sample quality but quality decline in mass production

- Samples using imported raw materials, mass production substituting domestic materials

- Samples handcrafted, mass production automation causing discrepancies

- Critical process parameter drift during mass production

Solutions:

- Locked Formulations: Contract clauses explicitly specifying raw material supplier brands and batch numbers

- First Article Inspection: Mandatory first article inspection before mass production with comparison to samples

- Process Validation: Require complete Process Performance Qualification (PPQ) reports

- Continuous Monitoring: Establish SPC (Statistical Process Control) to monitor key parameters

- Regular Sampling: Conduct periodic third-party sampling inspections for subsequent orders

6.2 Change Management

Core Problems:

- Suppliers changing raw material suppliers without approval

- Production equipment upgrades or relocations not notified

- Process parameter adjustments without change assessment

- Quality fluctuations from personnel turnover

Solutions:

- Change Control Protocols: Contract clauses requiring written approval for all changes

- Annual Audits: Conduct annual supplier audits to review change records

- Key Personnel Commitments: Require stability commitments for critical positions

- Joint Assessments: Major changes must undergo joint technical team evaluation

VII. Long-Term Cooperation & Risk Management

7.1 Supply Continuity Risks

Core Problems:

- Sudden supplier bankruptcy or acquisition

- Raw material supply chain disruptions (e.g., during pandemics)

- Production shutdowns due to environmental policy enforcement

- Regulatory factory closures from sudden quality incidents

Solutions:

- Dual-Source Strategy: Cultivate at least two qualified suppliers

- Safety Stock: Maintain 3-6 months of safety inventory

- Raw Material Transparency: Understand supplier’s upstream supply chain

- Continuity Planning: Jointly develop Business Continuity Plans (BCP) with suppliers

- Regular Assessments: Quarterly evaluations of supplier financial health

7.2 Relationship Maintenance & Improvement

Core Problems:

- Service quality decline after long-term cooperation

- Price negotiation deadlock

- Insufficient motivation for technical improvements

- Slow new product development response

Solutions:

- Strategic Partnerships: Elevate quality suppliers to strategic partner status

- Joint Improvement Projects: Establish collaborative projects for quality improvement and cost reduction

- Incentive Mechanisms: Create outstanding supplier awards with increased order allocation

- Regular Exchange: Organize annual supplier conferences for face-to-face communication

- Technology Sharing: Share market demands and technology trends while protecting core confidential information

Conclusion

While sourcing prefilled syringes from China presents significant challenges, a stable, high-quality supply chain is entirely achievable through systematic risk management and professional procurement strategies. The keys are:

- NEVER compromise quality standards for price advantages

- Invest sufficient resources in upfront due diligence

- Establish clear communication and quality management systems

- Maintain flexibility and long-term perspective

- Continuously learn about Chinese manufacturing characteristics and advantages

As you gain experience, you’ll discover that Chinese suppliers not only offer competitive pricing but can also become powerful partners in customization, rapid response, and technical innovation. The key to success is transforming challenges into opportunities for building robust business relationships.

Recommended Action Checklist:

- Conduct at least 1-2 on-site audits before first collaboration

- Prepare detailed supplier assessment scorecards (100+ inspection items)

- Establish internal China procurement SOPs

- Join medical device procurement industry associations for additional resources

- Consider establishing China procurement offices or hiring local procurement agents

We hope this guide helps you navigate the prefilled syringe sourcing journey from China with fewer detours and build successful supply chain partnerships!

CRITICAL SUCCESS FACTORS:

✓ Quality Cannot Be Negotiated – Regulatory compliance is non-negotiable

✓ Trust But Verify – Audit, test, and confirm everything

✓ Communication is Everything – Invest in bilingual technical teams

✓ Plan for the Long Term – Build relationships, not just transactions

✓ Risk Diversification – Never rely on a single supplier

Your sourcing success depends on treating Chinese suppliers as strategic partners while maintaining rigorous quality standards and comprehensive risk management protocols.