Medical syringes represent one of the most critical components in global healthcare delivery systems, serving as essential tools for vaccination programs, chronic disease management, and clinical treatments worldwide. The global medical syringe market has experienced unprecedented growth, driven by population aging, rising chronic disease prevalence, and the normalization of vaccination programs.

According to Grand View Research, the global medical syringe market reached $13 billion in 2023 and is projected to exceed $19 billion by 2030, representing a compound annual growth rate (CAGR) of 5.4%. This comprehensive analysis examines the global supply chain landscape, consumption patterns, technological innovations, and provides actionable insights for selecting premium syringe manufacturers, particularly in China’s manufacturing ecosystem.

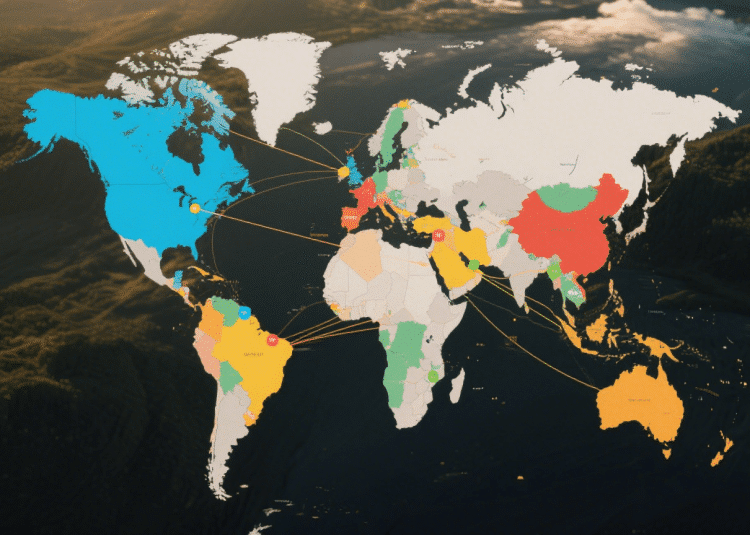

1. Global Production Supply Chain Distribution

1.1 Primary Manufacturing Regions

The global medical syringe manufacturing landscape follows a “Asia for Production, Europe-America for Technology” paradigm:

🇨🇳 China – The Global Manufacturing Hub

- World’s largest syringe exporter with over 18 billion units exported in 2023

- Complete plastic medical consumables supply chain integration

- Leading manufacturers: Weigao, Kohope, Jiangsu Jichun

- Cost advantage: 30-50% lower than Western counterparts

🇮🇳 India & Southeast Asia

- Focus on mid-to-low-end products with competitive pricing

- Emerging market with growing quality standards

- Strategic alternative sourcing destination

🇺🇸🇪🇺🇯🇵 Western Markets & Japan

- Specialization in high-end products: auto-injectors, safety syringes, smart injection devices

- Technology leaders: BD (Becton Dickinson), B. Braun, Terumo

- Premium pricing with advanced R&D capabilities

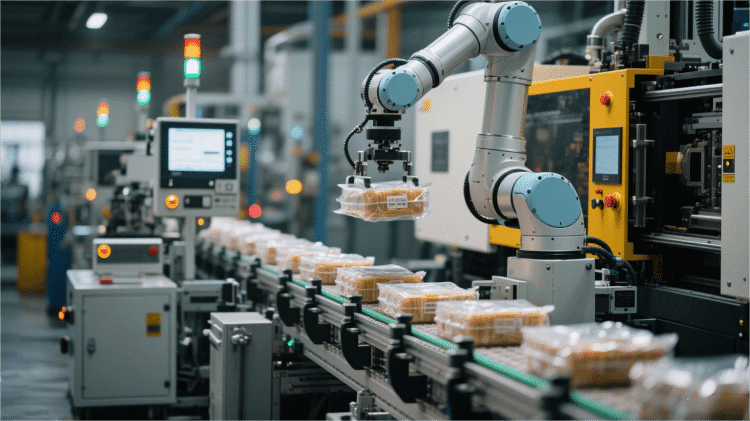

1.2 Critical Supply Chain Characteristics

| Characteristic | Description | Impact |

|---|---|---|

| Global Collaboration | Injection molding in Asia, precision molds and raw materials from Europe/US | Cost optimization with quality assurance |

| Stringent Quality Control | ISO 13485, CE, FDA certifications mandatory | Ensures global safety standards |

| High Automation Level | High-speed injection molding, online vision inspection, automated packaging | Consistent quality and scalability |

| Risk Resilience | Supply chain disruptions during COVID-19 highlighted vulnerabilities | Emphasis on diversified sourcing strategies |

2. Global Consumption Patterns & Applications

2.1 Regional Market Distribution

🌎 North America & Europe

- 55%+ of global market share in 2023

- High dependency on imports with premium quality requirements

- Strong regulatory compliance emphasis

🌏 Asia-Pacific Region

- Expected to contribute 60% of global market growth by 2030

- China and India as primary growth drivers

- Rapid healthcare infrastructure development

🌍 Middle East & Africa

- Rapid population growth with expanding healthcare access

- Untapped market potential with infrastructure limitations

2.2 Key Application Segments

| Application | Market Share | Growth Rate | Key Drivers |

|---|---|---|---|

| Vaccination Programs | ~35% | 4.8% CAGR | Global immunization initiatives |

| Diabetes Management | ~25% | 6.2% CAGR | Rising diabetes prevalence |

| Clinical Treatments | ~30% | 5.1% CAGR | Aging population, chronic diseases |

| Home Healthcare | ~10% | 8.3% CAGR | Telemedicine, self-administration |

3. Technological Innovation & Material Advances

3.1 Safety Technology Evolution

| Safety Type | Technology | Impact |

|---|---|---|

| Needle-stick Prevention | Auto-retractable needles, spring-loaded mechanisms | 80% reduction in healthcare worker infections |

| Reuse Prevention | Plunger lock mechanisms, spiral break structures | WHO-compliant single-use assurance |

| Dose Visualization | High-precision graduations, transparent polymer barrels | Enhanced medication accuracy |

3.2 Material & Environmental Innovation

🔬 Advanced Polymers

- Polypropylene (PP): Enhanced heat resistance and chemical compatibility

- Cyclic Olefin Copolymer (COC): Premium clarity and low protein adsorption

- Thermoplastic Elastomers (TPE): Improved plunger performance

🌱 Sustainable Solutions

- PLA (Polylactic Acid): Biodegradable options under development

- Recycling programs: Closed-loop manufacturing initiatives

- Carbon footprint reduction: Optimized logistics and local sourcing

3.3 Digital & Smart Integration

📱 Connected Healthcare

- Bluetooth-enabled injection tracking

- Mobile app integration for chronic disease management

- Real-time data collection and analysis

🤖 AI-Powered Quality Control

- Computer vision defect detection

- Predictive maintenance systems

- Automated batch tracking and traceability

4. China’s Manufacturing Advantage: Cost & Quality Balance

4.1 Cost Structure Advantages

| Cost Factor | China Advantage | Savings |

|---|---|---|

| Labor Costs | 20-30% of Western wages | 25-35% total cost reduction |

| Raw Materials | Integrated upstream supply chain | 15% material cost savings |

| Infrastructure | Industrial park clustering | 10-15% logistics savings |

| Scale Economy | Billion-unit annual capacity | 20-30% fixed cost amortization |

4.2 Quality-Price Equilibrium

🏭 Manufacturing Excellence

- German precision injection molding machines

- Japanese automated assembly lines

- CE/FDA/ISO 13485 compliance at 50-70% of Western pricing

📊 Performance Metrics

- 99.9%+ quality pass rate for leading manufacturers

- Sub-24 hour emergency response capability

- 99.5%+ on-time delivery performance

5. Premium Supplier Selection Framework

5.1 Essential Evaluation Criteria

🏆 1. International Certifications & Compliance

- Mandatory: ISO 13485, CE MDR, FDA 510(k), WHO PQ

- Domestic: Class II medical device manufacturing license

- Industry: GMP compliance, pharmacopeial standards

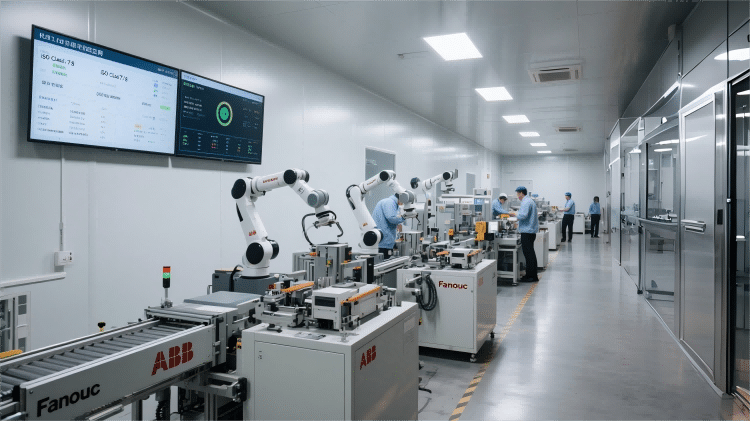

🏭 2. Production Capacity & Automation

- Cleanroom Standards: ISO Class 7/8 (10,000-100,000) facilities

- Automation Level: ABB, Fanuc robotic systems

- Scalability: 10+ million units monthly capacity

🔍 3. Quality Management & Traceability

- Batch Traceability: Full supply chain visibility

- Quality Control: AI-powered vision inspection, leak testing

- Documentation: Complete batch records and sample retention

🧬 4. R&D Capabilities & Customization

- Engineering Team: Registered engineers and mold designers

- OEM/ODM Services: Custom design and branding capabilities

- Innovation Pipeline: Smart product development capabilities

📦 5. Supply Chain Resilience

- Supplier Relationships: Long-term raw material partnerships

- Inventory Management: SAP/ERP integrated systems

- Risk Mitigation: Multi-sourcing and contingency planning

🌟 6. Market Reputation & Track Record

- Global Clients: BD, 3M, Cardinal Health partnerships

- International Projects: UN/WHO collaboration history

- Industry Presence: Major trade show participation (Arab Health, Medica)

6. Case Study: Shanghai Kohope Medical Devices Co., Ltd.

6.1 Company Overview & Credentials

📈 Two Decades of Excellence

- Established: 20+ years in medical consumables manufacturing

- Certifications: ISO 13485, CE, FDA approved

- Innovation: Multiple utility patents and technical certifications

6.2 Manufacturing Excellence

🏭 Production Capabilities

- Daily Capacity: 2+ million units across multiple product lines

- Quality Systems: Dual-tier inspection (inline + final product testing)

- Global Reach: Export to 80+ countries and regions

🎯 Key Performance Indicators

- Quality Pass Rate: 99.9%+

- On-time Delivery: 99.5%+

- Customer Satisfaction: 98%+ retention rate

6.3 Service & Customization Advantages

🎨 Custom Solutions

- OEM/ODM Services: Full branding and packaging customization

- Technical Support: Dedicated engineering team with remote audit capabilities

- Rapid Prototyping: 3-5 day sample delivery

🌍 Global Service Network

- Regional Warehouses: 3-5 day delivery to Europe/Americas

- Local Support: Multi-language customer service

- After-sales Service: 24/7 technical support hotline

7. Strategic Recommendations for Global Procurement

7.1 Supplier Selection Best Practices

🎯 Multi-dimensional Evaluation Prioritize suppliers based on four core pillars:

- Quality Assurance (30% weight)

- Cost Competitiveness (25% weight)

- Supply Chain Stability (25% weight)

- Regulatory Compliance (20% weight)

🔄 Risk Mitigation Strategies

- Dual-sourcing: Primary and secondary supplier relationships

- Geographic diversification: Regional supplier networks

- Inventory optimization: Strategic stock positioning

7.2 Long-term Partnership Development

🤝 Collaborative Approach

- Joint R&D initiatives: Co-develop next-generation products

- Capacity planning: Align production with demand forecasts

- Continuous improvement: Regular performance reviews and optimization

📊 Performance Monitoring

- KPI Dashboards: Real-time supply chain visibility

- Quality metrics: Statistical process control implementation

- Cost optimization: Regular benchmarking and value engineering

8. Future Outlook & Market Trends

8.1 Emerging Technologies

🚀 Next-Generation Innovations

- Smart Syringes: IoT-enabled dose tracking and patient monitoring

- Sustainable Materials: Biodegradable and recyclable alternatives

- Nanotechnology: Enhanced drug delivery and biocompatibility

8.2 Market Dynamics

📈 Growth Drivers

- Aging Population: Increased chronic disease management needs

- Vaccination Programs: Routine immunization expansion

- Home Healthcare: Self-administration and telemedicine growth

🌍 Regional Opportunities

- Emerging Markets: Africa, Latin America infrastructure development

- Developed Markets: Premium product segment expansion

- Regulatory Harmonization: Streamlined global approval processes

Conclusion

The global medical syringe industry stands at a pivotal juncture, balancing rapid growth with evolving quality and safety requirements. China’s manufacturing ecosystem has successfully transitioned from a low-cost provider to a high-quality, high-efficiency partner in the global healthcare supply chain.

Key Takeaways for Global Procurement Teams:

- Prioritize Quality: Certification and compliance are non-negotiable

- Embrace Innovation: Partner with suppliers investing in R&D and technology

- Build Resilience: Develop diversified, risk-mitigated supply chains

- Focus on Total Cost: Consider quality, service, and reliability beyond unit price

Shanghai Kohope Medical Devices Co., Ltd. exemplifies the evolution of Chinese manufacturing, combining two decades of industry expertise with modern production capabilities and global service standards. By partnering with such established suppliers, global healthcare organizations can achieve the optimal balance of cost efficiency, quality assurance, and supply chain reliability.

The future of medical syringes lies in safety, intelligence, and sustainability. Organizations that align with forward-thinking suppliers and embrace technological innovation will be best positioned to meet the evolving needs of global healthcare systems.

For additional information about supplier evaluation, market analysis, or customized procurement strategies, please contact our team of medical device supply chain experts.