In the modern US healthcare system, vacuum blood collection tubes serve as more than just basic laboratory consumables—they are critical components ensuring diagnostic accuracy and patient safety. For healthcare facilities, distributors, and wholesalers, understanding how to scientifically select tube types, maintain quality standards, optimize inventory, and navigate market trends directly impacts operational efficiency and service quality.

This comprehensive guide analyzes vacuum blood collection tubes from multiple perspectives including product technology, clinical applications, procurement strategies, and distribution management, helping healthcare industry stakeholders enhance their competitive advantage in the medical consumables market.

I. Primary Types of Vacuum Blood Collection Tubes and Clinical Applications

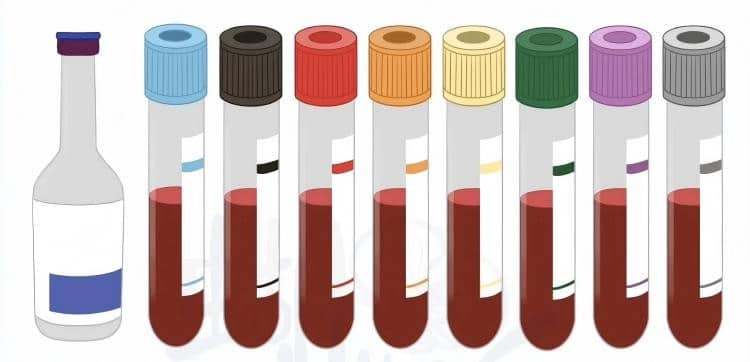

Different colored tube caps represent specific additives and intended uses. Here’s a breakdown of the most commonly used blood collection tube types in US clinical practice:

🔴 Red Top Tubes (No Additive/Clot Activator)

Technical Specifications:

- Material: Borosilicate glass or PET plastic

- Volume range: 3-10ml

- Clotting time: 30-60 minutes

- Serum separation efficiency: >95%

Clinical Applications:

- Chemistry panels: Comprehensive metabolic panels (CMP), liver function tests

- Immunology: Antibody/antigen detection, allergy testing

- Endocrinology: Hormone level assessments

- Therapeutic drug monitoring (TDM)

Key Market Position: Essential for routine laboratory testing in outpatient clinics and hospital laboratories

🟣 Purple/Lavender Top Tubes (EDTA-K2)

Technical Specifications:

- Anticoagulant: Ethylenediaminetetraacetic acid dipotassium salt

- Concentration: 1.5-2.2 mg/ml of blood

- Mixing requirement: Invert 8-10 times immediately after collection

- Storage: 2-8°C for optimal stability

Clinical Applications:

- Complete Blood Count (CBC): White blood cell count, hemoglobin, hematocrit

- Blood typing and crossmatching

- Flow cytometry for hematologic malignancies

- Molecular diagnostics (DNA/RNA extraction)

Market Significance: Highest volume consumption in emergency departments and routine screening programs

🔵 Blue Top Tubes (Sodium Citrate)

Technical Specifications:

- Anticoagulant: 3.2% sodium citrate (most common in US)

- Blood-to-anticoagulant ratio: 9:1 (critical for accuracy)

- Testing window: 2-4 hours post-collection

- Storage: Room temperature transport acceptable

Clinical Applications:

- Coagulation studies: PT/INR, PTT, fibrinogen

- Factor assays: Factor VIII, Factor IX, von Willebrand studies

- Specialty coagulation: Lupus anticoagulant, protein C/S

- Platelet aggregation studies

Regulatory Note: Must comply with CLSI standards for coagulation testing

🟢 Green Top Tubes (Heparin)

Technical Specifications:

- Anticoagulant: Lithium heparin (most common) or sodium heparin

- Concentration: 15-20 IU/ml of blood

- Plasma separation: Immediate availability

- Stability: 4-6 hours at room temperature

Clinical Applications:

- STAT chemistry: Emergency electrolytes, glucose, BUN/creatinine

- Arterial blood gas (ABG) analysis

- Point-of-care testing (POCT)

- Toxicology screening

Critical for: Emergency departments, ICUs, and urgent care facilities

⚫ Gray Top Tubes (Sodium Fluoride/Potassium Oxalate)

Technical Specifications:

- Preservative: Sodium fluoride (glycolytic inhibitor)

- Anticoagulant: Potassium oxalate

- Glucose stability: 24 hours at room temperature

- Mixing: Invert 8-10 times immediately

Clinical Applications:

- Glucose tolerance tests (GTT)

- Postprandial glucose monitoring

- Lactate measurement

- Forensic alcohol testing

Specialized Use: Primary choice for diabetic monitoring and metabolic studies

🟡 Gold/Yellow Top Tubes (Serum Separator Tubes – SST)

Technical Specifications:

- Contains: Clot activator + inert gel separator

- Centrifugation: 1,000-1,300 x g for 10 minutes

- Serum stability: 48 hours refrigerated

- Separation efficiency: >99%

Clinical Applications:

- Tumor markers: PSA, CEA, CA 19-9

- Cardiac markers: Troponin, CK-MB, BNP

- Immunoassays: Thyroid function, reproductive hormones

- Therapeutic drug monitoring

Advantage: Extended stability for batch testing and send-out specimens

II. Department-Specific Procurement Guidelines

Based on US healthcare facility requirements, here are evidence-based tube allocation recommendations:

🏥 Outpatient Clinics & Physician Offices

Primary needs: Routine wellness exams, chronic disease monitoring

- Recommended allocation: Purple 40%, Red 30%, Blue 15%, Green 10%, Other 5%

- Annual volume: 10,000-50,000 tubes

- Key suppliers: BD, Greiner Bio-One, Sarstedt

🚨 Emergency Departments

Primary needs: Rapid turnaround diagnostics, critical care

- Recommended allocation: Green 35%, Purple 30%, Red 25%, Blue 10%

- Annual volume: 50,000-200,000 tubes

- Priority: STAT-compatible tubes with rapid processing capability

🛏️ Inpatient Units & Hospital Labs

Primary needs: Comprehensive testing, specialized assays

- Recommended allocation: Red 25%, Purple 25%, Blue 20%, Green 15%, Gold 10%, Other 5%

- Annual volume: 100,000-500,000 tubes

- Focus: Full-spectrum coverage including specialty tubes

III. Quality Standards & Regulatory Compliance

FDA & CLIA Requirements

All vacuum blood collection tubes used in US healthcare must meet stringent quality standards:

| Parameter | Requirement | Testing Standard |

|---|---|---|

| Vacuum integrity | ±10% of stated volume | ISO 6710 |

| Anticoagulant accuracy | ±5% of target concentration | USP standards |

| Sterility | 100% sterile | FDA 21 CFR 820 |

| Endotoxin levels | <0.25 EU/ml | USP <85> |

| Hemolysis rate | <0.5% | CLSI H18-A4 |

Storage & Distribution Standards

Temperature control: 4-25°C (39-77°F) Humidity: ≤75% RH Packaging: Light-resistant, tamper-evident Shelf life: Typically 12-24 months from manufacture

IV. Distributor Procurement Strategy

Healthcare Facility Segmentation

| Facility Type | Annual Volume | Price Sensitivity | Key Requirements |

|---|---|---|---|

| Critical Access Hospitals | 25,000-100,000 | High | Cost-effective, basic tube types |

| Community Hospitals | 100,000-500,000 | Moderate | Quality assurance, diverse inventory |

| Academic Medical Centers | 500,000+ | Low | Innovation, specialized products |

| Reference Labs | 1,000,000+ | Low | Volume discounts, custom solutions |

Vendor Selection Criteria

Essential qualifications:

- FDA 510(k) clearance for all products

- ISO 13485 quality management certification

- cGMP compliance (Current Good Manufacturing Practices)

- Track record with major US health systems

Preferred partnerships:

- BD (Becton Dickinson): Market leader, comprehensive portfolio

- Greiner Bio-One: Premium quality, European manufacturing

- Sarstedt: Innovative designs, competitive pricing

- Terumo: Specialty products, Japanese quality standards

V. Wholesale Distribution Excellence

Product Portfolio Optimization

Core products (60% of revenue):

- Standard vacuum tubes (red, purple, blue tops)

- High-volume SKUs for routine testing

- Private label opportunities for cost-conscious buyers

Specialty products (25% of revenue):

- Pediatric tubes (smaller volumes, safety features)

- Micro-collection tubes for point-of-care testing

- Trace element tubes for specialized testing

Ancillary products (15% of revenue):

- Blood collection sets (butterfly needles, holders)

- Tube racks and accessories

- Centrifuge equipment

Customer Development Strategy

Tier 1 customers (Health Systems):

- White-glove service: Dedicated account management

- Value-added services: Inventory management, usage analytics

- Custom solutions: Private labeling, specialized packaging

Tier 2 customers (Independent hospitals):

- Technical support: Clinical education, troubleshooting

- Flexible ordering: Multiple delivery options

- Competitive pricing: Volume-based discounts

Tier 3 customers (Clinics, urgent care):

- Simplified ordering: Online catalogs, standardized SKUs

- Fast delivery: Same-day/next-day shipping

- Educational resources: Best practices, regulatory updates

Supply Chain Optimization

Distribution network:

- Regional warehouses: 2-day delivery coverage

- Just-in-time delivery: Reducing customer inventory costs

- Cold chain management: Temperature-sensitive products

- Inventory turnover target: 8-12 times annually

VI. Market Trends & Future Opportunities

Technology Integration

Digital transformation:

- RFID tracking: Real-time inventory visibility

- Barcode automation: Reduced labeling errors

- IoT sensors: Temperature monitoring during transport

- AI-powered analytics: Predictive inventory management

Sustainability initiatives:

- Eco-friendly materials: Biodegradable plastics

- Recycling programs: Tube collection and processing

- Carbon footprint reduction: Local manufacturing, efficient logistics

Market Growth Drivers

Demographic trends:

- Aging population: Increased testing volume (65+ demographic growing 3% annually)

- Chronic disease prevalence: Diabetes, cardiovascular disease monitoring

- Preventive care emphasis: Wellness programs, early detection

Healthcare policy impacts:

- Medicare Advantage growth: Increased outpatient testing

- Value-based care: Quality metrics driving testing requirements

- Telehealth expansion: Remote monitoring, at-home collection

Market size projections:

- Current US market: $2.1 billion (2024)

- Projected growth: 5.2% CAGR through 2029

- Key segments: Hospital labs (45%), reference labs (35%), physician offices (20%)

Competitive Landscape

Market leaders:

- BD: 35% market share, innovation focus

- Greiner Bio-One: 15% market share, premium positioning

- Sarstedt: 12% market share, value proposition

- Others: 38% combined (Terumo, Nipro, regional players)

Emerging opportunities:

- Point-of-care testing: Rapid diagnostics growth

- Personalized medicine: Specialized tube requirements

- Direct-to-consumer: At-home testing market expansion

VII. Regulatory & Compliance Considerations

FDA Oversight

Device classification: Class II medical devices Quality system requirements: 21 CFR Part 820 Labeling standards: 21 CFR Part 801 Adverse event reporting: MDR requirements

Clinical Laboratory Standards

CLSI guidelines:

- H18-A4: Procedures for handling and transport

- H21-A5: Collection, transport, and processing

- GP41-A6: Evacuated tubes for blood specimen collection

CAP accreditation: Laboratory compliance requirements CLIA regulations: Personnel and quality standards

Conclusion

The vacuum blood collection tube market in the United States represents a critical component of the healthcare supply chain, with annual consumption exceeding 3 billion tubes. Success in this market requires a deep understanding of clinical applications, regulatory requirements, and customer needs across diverse healthcare settings.

Key success factors:

- Product expertise: Understanding clinical applications and technical specifications

- Quality assurance: Maintaining FDA compliance and customer confidence

- Supply chain excellence: Reliable delivery and inventory management

- Customer relationships: Providing value-added services and technical support

Strategic recommendations:

- Diversify product portfolio to include specialty and emerging categories

- Invest in technology for supply chain optimization and customer service

- Build strategic partnerships with leading manufacturers and health systems

- Focus on value-added services to differentiate from commodity competitors

The future of the vacuum blood collection tube market will be shaped by technological innovation, regulatory evolution, and changing healthcare delivery models. Organizations that adapt to these trends while maintaining operational excellence will be best positioned for long-term success.

For custom product catalogs, wholesale pricing solutions, or additional market analysis regarding vacuum blood collection tube procurement, please contact our team for specialized consultation.

Would you like us to develop supplementary materials such as competitive analysis charts, ROI calculators, or customer presentation templates for your sales team?